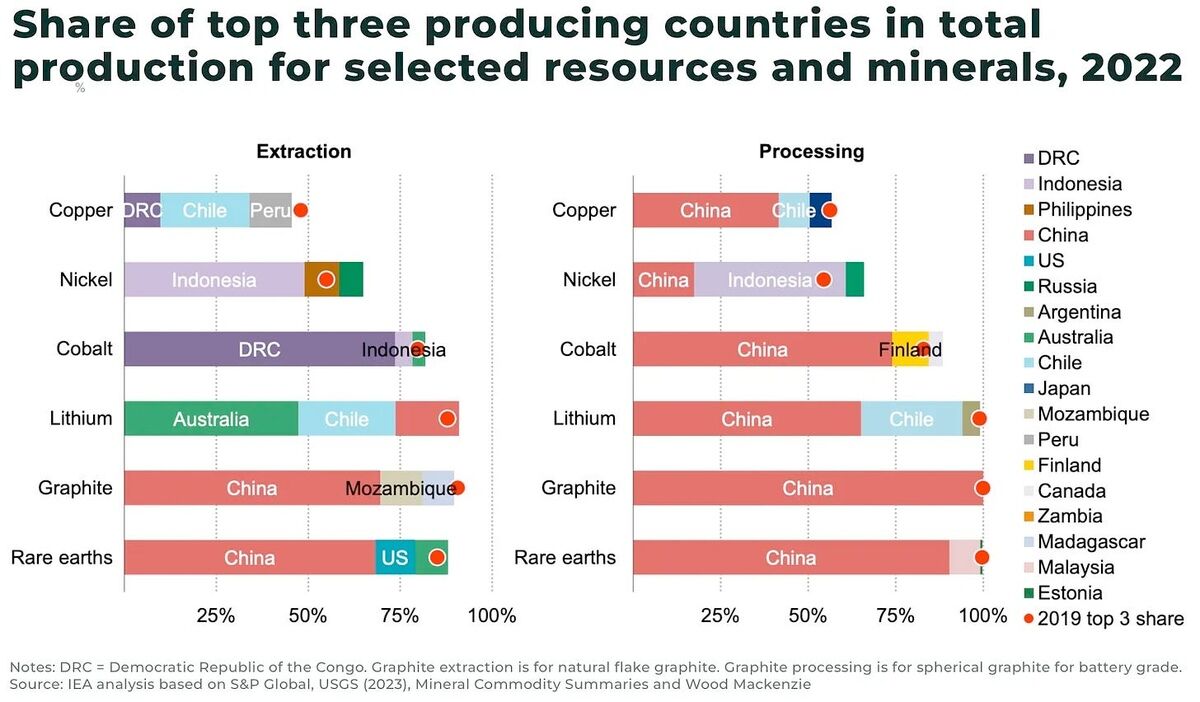

Above and previous exposing America’s lack of essential minerals mining and processing, China’s ban on the exports of antimony, gallium, and germanium shines a spotlight on the near depletion of nationwide reserves of mined commodities crucial to the nation’s monetary system and security.

Very important minerals and vitality analysts at The Oregon Group stage out that the US does have a Nationwide Safety Stockpile to draw essential minerals from in case of emergencies, nonetheless this retailer of provides meant to get the nation by emergencies equal to warfare or a severe present disruption has been neglected for a few years and is sort of depleted.

Consistent with a late 2023 Congressional report, the Nationwide Safety Stockpile held $912 million of complete provides, which could solely present an estimated 6% of what is required to fulfill U.S. navy and civilian desires all through a nationwide emergency.

“The overwhelming majority of the US$13.5 billion gap between current stockpile property and current stockpile requirements would assist nondefense essential infrastructure demand throughout the event of an assault on the US,” in accordance with the Emergency Entry to Strategic and Very important Provides: The Nationwide Safety Stockpile report delivered to Congress in November 2023.

Shortly after this Congressional Evaluation Service report landed on Capitol Hill, the U.S. Dwelling Select Committee on the Chinese language language Communist Event generally known as for investing $1 billion proper right into a “Resilient Helpful useful resource Reserve” to help insulate American producers throughout the event that the People’s Republic of China (PRC) weaponized its dominance of essential mineral present chains.

Their thought incorporates using the Resilient Helpful useful resource Reserve as a tool to diploma out market fluctuations by looking for and stockpiling essential minerals all through cases when the PRC makes use of its present chain dominance to flood the market with essential minerals, driving prices down and discouraging opponents; after which promote essential minerals out of the reserve when the communist nation artificially drives up prices with export restrictions.

“This is ready to be very like how the US Strategic Petroleum Reserve (SPR) is used,” The Oregon Group penned in a Dec. 23 report on the rising essential mineral stockpile race.

Boron, cobalt, gallium, germanium, graphite, manganese, unusual earths, and vanadium have been listed throughout the Dwelling committee report as extraordinarily dangerous essential minerals that must be saved in a replenished nationwide stockpile.

Worldwide Energy Firm

Weaponizing essential minerals

Points that China might weaponize its dominance over worldwide essential mineral present chains all through an escalating commerce warfare with the U.S. have come to fruition.

After firing a variety of warning images inside the kind of requiring Chinese language language companies to acquire authorities authorization sooner than supply a rising document of essential minerals out of the communist nation, China hit American producers in early December with a complete ban on the exports of antimony, gallium, and germaniumto the U.S.

These mined commodities are essential to high-tech manufacturing and navy readiness.

Consistent with the U.S. Geological Survey, the ban on gallium and germanium utilized in laptop computer chips and totally different high-tech capabilities might ship America’s gross residence product (GDP) plummeting by $3.4 billion.

“Dropping entry to essential minerals that make up a fraction of the price of merchandise like semiconductors and LEDs can add as a lot as billions of {{dollars}} in losses all through the monetary system,” talked about Nedal Nassar, lead author of the USGS gallium and germanium analysis.

Antimony is extreme on the Pentagon’s essential minerals due to its use in ammunition, fireproofing compounds, night time time imaginative and prescient gear, and quite a lot of totally different navy and civilian makes use of.

China (48%), Tajikistan (25%), and Russia (5%) administration virtually 80% of the world’s antimony present.

In a 2022 report, the U.S. Dwelling Armed Firms Committee talked about it “is apprehensive about newest geopolitical dynamics with Russia and China and the best way which may velocity up present chain disruptions, notably with antimony.”

China moreover leverages its present chain dominance to hold onto its monopoly by flooding the market and driving down prices to a level the place mines and processing companies exterior of its administration aren’t worthwhile. The communist nation used this system just a few decade previously to retain administration of unusual earths, and it is now using the similar method to push down the price of nickel wished for electrical vehicle batteries.

Reuters

Cautious administration of nationwide stockpiles might enhance the extent of pure and artificial market volatility.

China is stockpiling

The Oregon Group components out that together with dominating the mining and processing of essential minerals, China maintains huge stockpiles of these necessary components.

“The official dimension and strategy of China’s nationwide commodity stockpiles are state secrets and techniques and strategies – run by China’s Nationwide Meals and Strategic Reserves Administration (or, State Reserve Bureau) – nonetheless is reported to stock aluminum, antimony, cadmium, cobalt, gallium, germanium, indium, molybdenum, unusual earth components, tantalum, tin, tungsten, and zirconium,” the essential minerals and vitality evaluation company wrote.

Together with essential minerals, The Oregon Group says China is reportedly stockpiling huge reserves of oil, coal, and grain.

The evaluation company says there are a selection of doable causes for the elevated stockpiling of commodities:

• As a solution to retailer essential minerals as a result of the monetary system slows.

• As nationwide security prepares for a battle, equal to over Taiwan.

• Preparation for a commerce warfare with potential tariffs from the Trump administration.

“We personally assume an invasion of Taiwan is unlikely, and China is, instead, preparing for a commerce warfare,” The Oregon Group wrote. “Nevertheless, whatever the trigger, the result’s comparable: these stockpiles give China important leverage over every the market and the West.”

Steno Evaluation, Bloomberg, Macrobond

China has added significantly to its copper stockpiles.

Upside and draw again

The developing of U.S. essential minerals stockpiles to chop again China’s leverage and insulate American producers from artificial and pure present shortages has emerged as a topic touted all through the political spectrum.

Whereas on the presidential advertising and marketing marketing campaign path, Vice President Kamala Harris laid out plans to find out a nationwide reserve of essential minerals very like the Resilient Helpful useful resource Reserve proposed by the Dwelling Select Committee on the Chinese language language Communist Event.

All through his first time interval in office, President-elect Donald Trump requested Congress for $1.5 billion over 10 years to assemble a stockpile of U.S-mined uranium.

Bipartisan assist for a nationwide essential mineral stockpile will attainable improve as American producers actually really feel the have an effect on of China’s export bans.

The Oregon Group says that rising essential mineral reserves throughout the U.S. might have important upside and draw again impacts within the market.

On the upside, the creation of a nationwide essential mineral stockpile throughout the U.S. would attainable:

• Help bigger prices which may encourage additional investments in residence present chains.

• Encourage elevated worldwide cooperation all through the mining sector throughout the West.

• Help to diversify worldwide essential mineral present chains away from China.

“A US nationwide stockpile is essential as a buffer in any nationwide emergency, and low prices all through many essential minerals, equal to nickel, affords a super various for governments to buy,” The Oregon Group wrote.

The draw again impacts might embrace:

• Further strains on the provision of minerals which will be already in extreme demand for the vitality transition.

• Market distortions and volatility from huge purchases or product sales from stockpile mismanagement.

• An exacerbation of geopolitical tensions, helpful useful resource nationalism, and demanding mineral export restrictions.

The Oregon Group says that the faster the U.S. builds nationwide stockpiles, the higher the stress it’s going to positioned on worldwide essential mineral present chains, which could attainable intensify among the many draw again impacts which may associate with that.

“Already, demand is predicted to exceed present all through an expansion of essential minerals due to net-zero targets, safety progress, and the surge of data services for artificial intelligence,” the evaluation company wrote. “Elevated stockpiling efforts would possibly compound present pressures, heightening the hazard of short-term worth volatility and market destabilization.”

This leaves the incoming Trump administration and Congress with the responsibility of balancing the need to replenish America’s essential minerals cupboard with out creating an extreme quantity of present chain, market, and geopolitical volatility.

Further particulars of The Oregon Group analysis could possibly be be taught throughout the “Can the US match China’s essential mineral stockpiles?” article authored by Anthony Milewski.